Standardizing Sustainability – How the IWA Will Make This Happen

By - Marley Gray, Principal Architect – Azure Multiparty Engineering, Microsoft

In an earlier pair of blog posts, I described how the InterWork Alliance came to be and how we are focused on simplifying the digital interchange of tokenized value for virtually any use case (Part 1 and Part 2). In Part 2 I mentioned that sustainability use cases are very clear candidates for standardization because there are significant and myriad differences among the many organizations and entities trying to define what sustainability means, how it should be measured and accounted for, and what information can be certified. I’d like to expand on this thought and show how the IWA is working to tackle this problem by ‘standardizing sustainability’.

A starting view of sustainability – global carbon emissions mitigation

Concerns over climate change are not just at the government level; many corporations and investors now recognize that climate-related risks are tantamount to business risks and have therefore ‘seen the light’. A large number of publicly-traded companies are already committing to deliver on a wide variety of large scale, enterprise-wide sustainability plans – more generally referred to as environmental, social, and governance (ESG) plans. In this post I’ll focus on one specific ESG use case: voluntary markets for reducing the world’s carbon footprint.

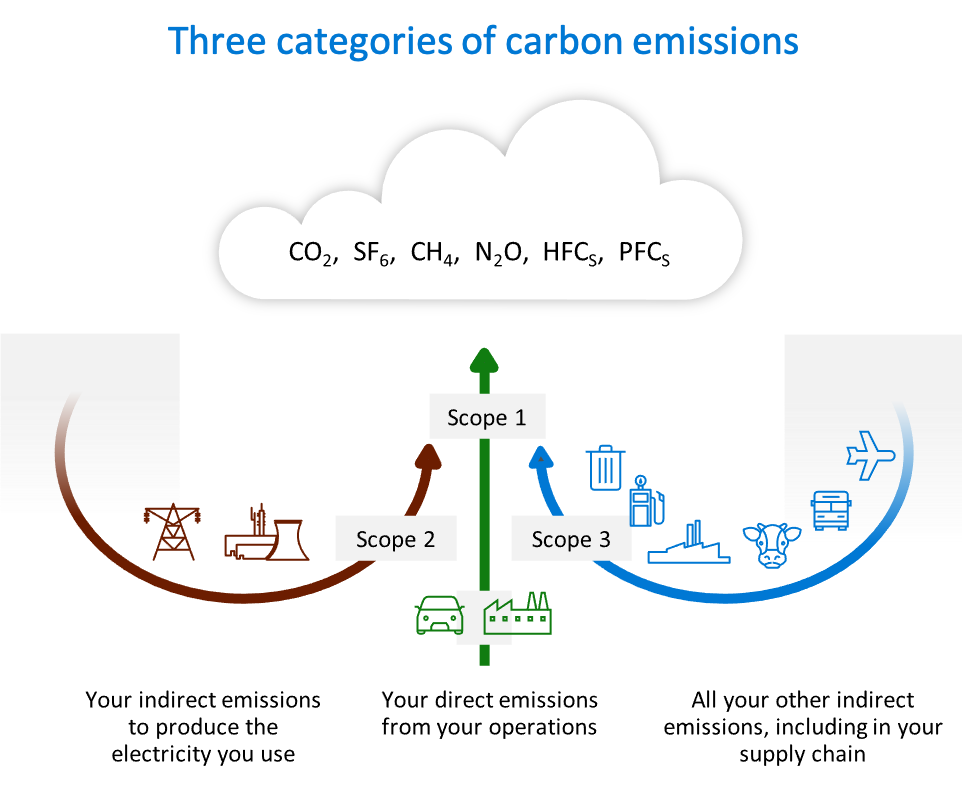

Since 1992, there have been dozens of national laws and multilateral agreements that seek to address the physical impacts of climate change and accelerate a transition away from reliance on carbon-intensive industries. The UN Framework Convention on Climate Change (UNFCCC) resulted in the signing of the Kyoto Protocol in 1997, creating a market-based mechanism that allowed developed countries to offset their greenhouse gas (GHG) emissions by purchasing certified credits from approved and verified emission reduction projects in developing countries. These carbon credits were then linked by the European Union and other countries to national cap-and-trade regimes that regulated industries, thereby allowing companies a cost-effective means of achieving compliance based in part on the price of carbon.

Then, In 2015, 185 nations agreed to do more with emerging support from corporations and financial institutions. Under the UNFCCC Paris Agreement, every nation agreed to make a voluntary nationally-determined contribution (i.e. emissions reduction) toward a collective goal of keeping global temperatures under 2 degrees Celsius warming by 2050. Since then, an array of voluntary and compliance markets have been established where verified carbon credits are both cost-effective instruments to reduce global emissions as well as catalysts for financing investments in carbon-reducing products and activities.

In short, carbon credits provide a key driver and incentive for any organization committing to a sustainability plan. They enable a company the means to cost-effectively offset its own carbon dioxide emissions while giving a company the needed time to prioritize and allocate resources and capital into longer-term direct emissions reductions achieved by cleaner technologies, fuels, and supply chains. Purchasing credits allow companies to invest in climate action, claim the achievement of near-term goals, and to sell any surplus credits they do not consume to organizations that do not have enough credit to cover their own emissions.

What exactly is a carbon credit?

There are generally two types of carbon credits: emission allowances and carbon offsets. Emission allowances are creatures of government regulation. Allowances are regulatory permits to emit one ton of carbon-equivalent (identified as CO2e) greenhouse gases. Permits are either allocated or auctioned to regulated entities, subject to a permitted cap – meaning that the regulated entity has to purchase allowances if its actual emissions exceed its allocation. If the original owner’s actual emissions are below its allowance allocation, it can sell the surplus to other entities.

A carbon offset is an intangible asset that is created by project owners. An offset is minted when it becomes issued in an environmental registry, something that happens upon verification that one ton of CO2e greenhouse gases have either been avoided (e.g. clean electricity), reduced (e.g. sustainable fuels), or sequestered (e.g. avoided deforestation, sustainable farming) by an approved project or activity. That offset represents the original owner’s property right claims to those carbon-related benefits. The owners can then sell their credits directly to buyers or at wholesale. The ultimate end-user has the right to claim the benefits and an ability to retire the credit permanently – usually as part of netting the claimed CO2e benefits against that end-users other GHG emissions.

What obstacles are there to carbon offsets?

Some of the main problems with carbon credit markets have been scalability and credibility. In the 23 years since the Kyoto Protocol was first signed, government-led efforts to devise and implement meaningful climate action have been fraught with political delay, economic indecision, and lack of standardization and transparency in carbon accounting – and yes, some fraud in offset verification and permanence.

All these obstacles have occurred precisely as the reality of climate change been progressively better understood and digested by businesses and society. In lieu of government or multilateral action, the private sector’s focus has turned to voluntary carbon markets to make near-term progress while regulatory frameworks mature. In a voluntary market, organizations make ESG pledges and report their emission reduction progress as buyers, and carbon offset projects are verified by third-party auditors who deliver verification reports to registries that issue carbon offsets project owners as the original sellers.

While this sounds promising, the ecosystem around ESG pledges and the creation of offsets is still a balkanized, patchwork approach using an array of different standards, methodologies, and registry regimes. There is no common architecture globally that brings a rather unique intersection of organizations together around such an expansive challenge of measuring and verifying CO2e emission reductions – particularly when many ESG taxonomies are more qualitative than quantitative. Such disaggregation makes it very difficult to deliver the necessary incentives for a network of participants to act if the international financial markets are not properly integrated, and impossible to isolate the largest emitters if there no common means of verifying results and measuring progress.

Action is now underway to harmonize carbon accounting and to effectively create generally-accepted carbon accounting principles. Until that happens, though, the current and growing set of necessarily complex carbon accounting standards, coupled with multiple independent verifiers for reporting and numerous exchanges for trading, has left us with an unwieldy process, island exchanges, and siloed marketplaces.

At the IWA, we believe that driving standards for carbon emissions, offsets, and green energy production – as well as for trading and derivatives contracts – is key to aligning the exchange of value between organizations. Tokenizing the outputs of verified reporting standards, in a standard way, could unlock a much more robust ecosystem – leading to the establishment of a common representation of carbon accounting standards and an international, trusted distributed network for combatting climate change.

Tokenization creates cryptographically authentic value representations for emissions and offsets that also carries the data needed by all parties to determine value. Tokens are owned and can be exchanged, leveraged, bundled, referenced, insured, speculated, and consumed by the parties participating in the marketplace. The tokenization process would not replace existing processes and accounting standards, but simply establish a standard digital asset representation that references the data and processes that generated it.

How the IWA is approaching the sustainability problem

The members of the IWA are planning to address the needs of the carbon emissions market with a technology-neutral solution that standardizes tokenization of key elements, clauses for ledgering templates, and market-driven multi-party analytics. We believe that this will finally allow organizations with widely divergent views to define common implementation and accounting templates that are able to eliminate fraud, incentivize behavior change, be transparent, and engage new technologies.

Today the IWA announced the formation of our Sustainability Business Working Group (BWG), which will establish the standards for tokenization, contractual extensions, workflows, and analytics for GHG/Carbon emissions and offsets. These standards will serve as foundations for both voluntary and regulated carbon markets using distributed ledger techniques to create an auditable ecosystem. Initially, the primary focus will be voluntary carbon market architectures and will later expand to regulated markets; the main categories of focus will be emissions, offsets, and contracts.

As an IWA BWG, members will work together at a business-need level to define this scenario and specific market requirements into a pre-framework draft, which the Technical Working Groups (TWGs) will use to develop open, standards-based specifications, frameworks, and tooling that enable multi-party solutions to be built that satisfy the needs of the global carbon mitigation marketplace.

What this means to Microsoft

Microsoft’s sustainability efforts have led the industry since 2009. Our newly announced goals to become carbon negative by 2030 – and remove all historical emissions by 2050 – set the bar higher.

These new goals cannot be achieved if we simply focus on our own emissions; even if we could achieve them and no one else could, we fail. So, all of us must work together to raise the tide so all organizations can achieve emissions reductions. We’re excited to be teaming with both our customers, partners, and competitors in the IWA to develop a set of global standards that all can use to succeed in this endeavor.

Establishing standards for reporting and tokenization can help bring trust in the global carbon ecosystem. Establishing this trust across borders, using voluntary corporate reporting matched with accurate offset token generation, can bring much needed private capital and investment to the table to help address global climate change.

I’d like to thank Cameron Prell from Xpansive, an IWA Principal Member, for his insights while writing this post. For more information and an example of the thought leadership represented in the group, I encourage you to read Principles for Building a Common Data Governance Framework for Market & Environmental Integrity, co-authored by Cameron and his colleague Jeff Cohen.

Are you ready to join us? Become an IWA member and let’s solve this problem together!